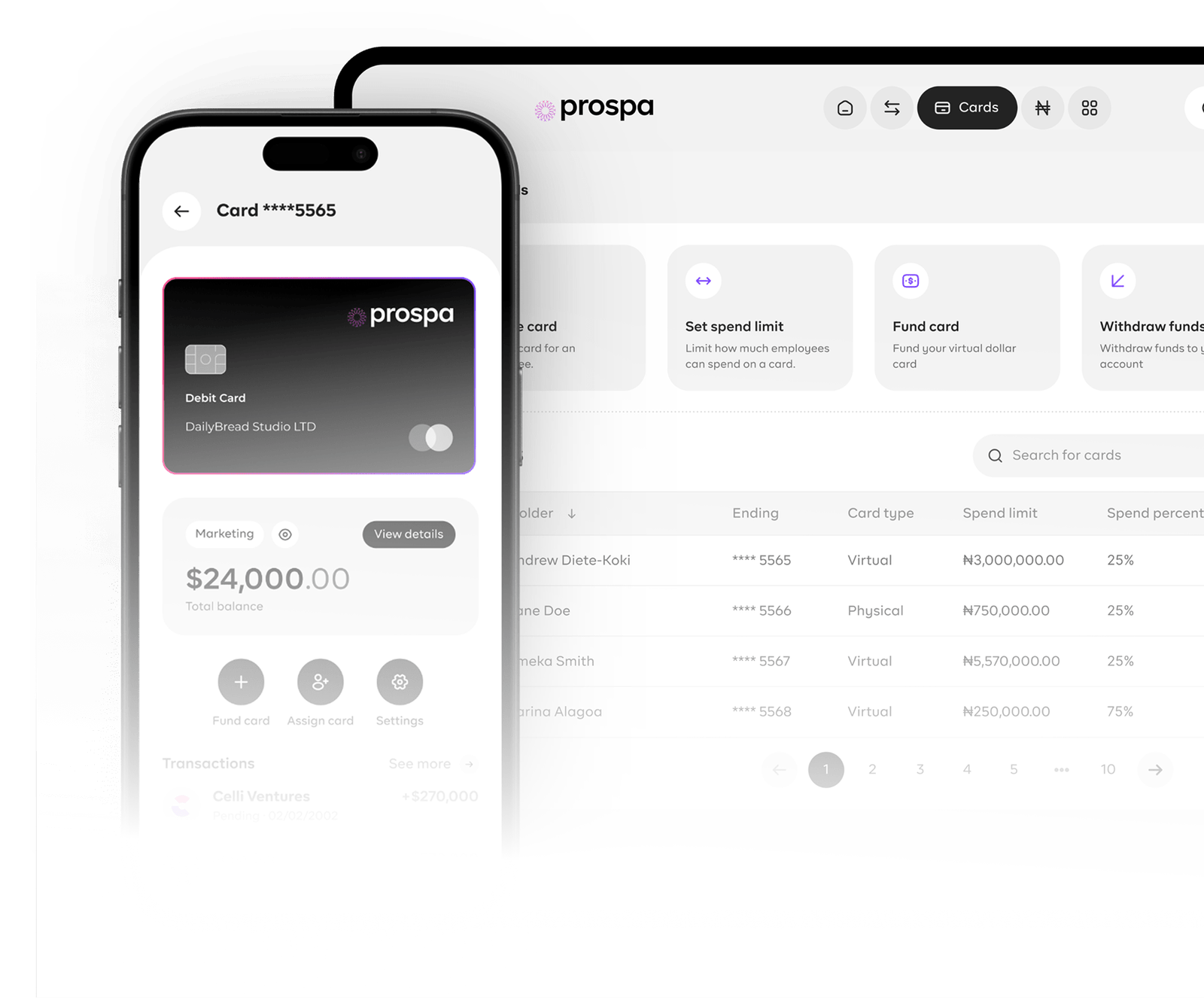

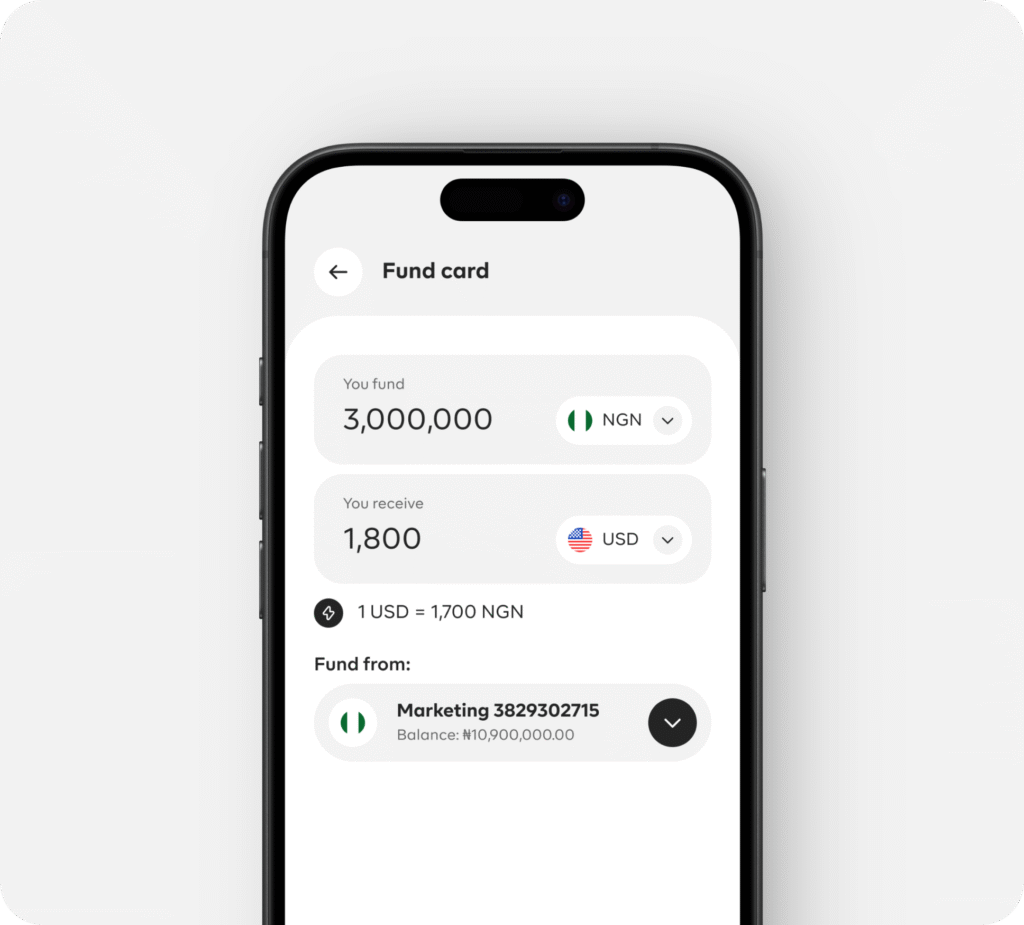

Instantly issue expense cards

Quickly deploy expense cards for company spending. Equip your team with cards that simplify and streamline everyday transactions.

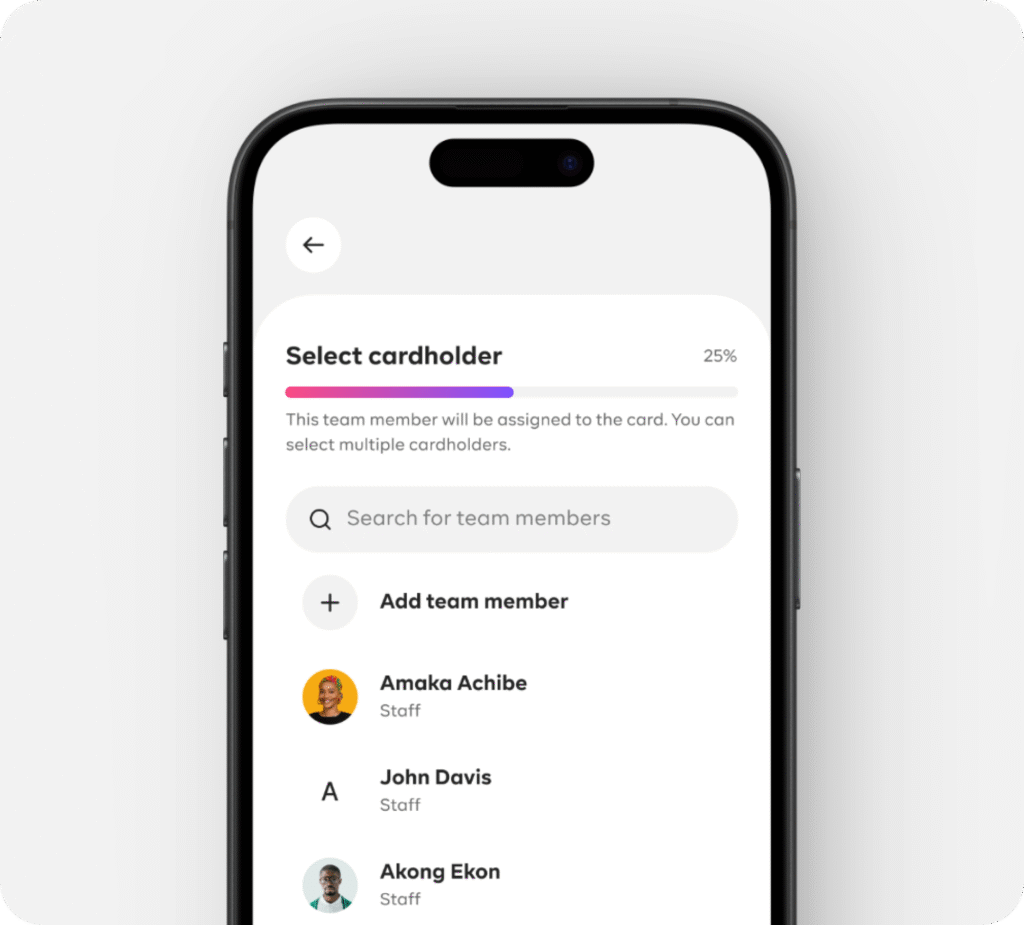

Add team members seamlessly

Easily add or remove team members from your expense card program. Manage who has access and control spending effortlessly.

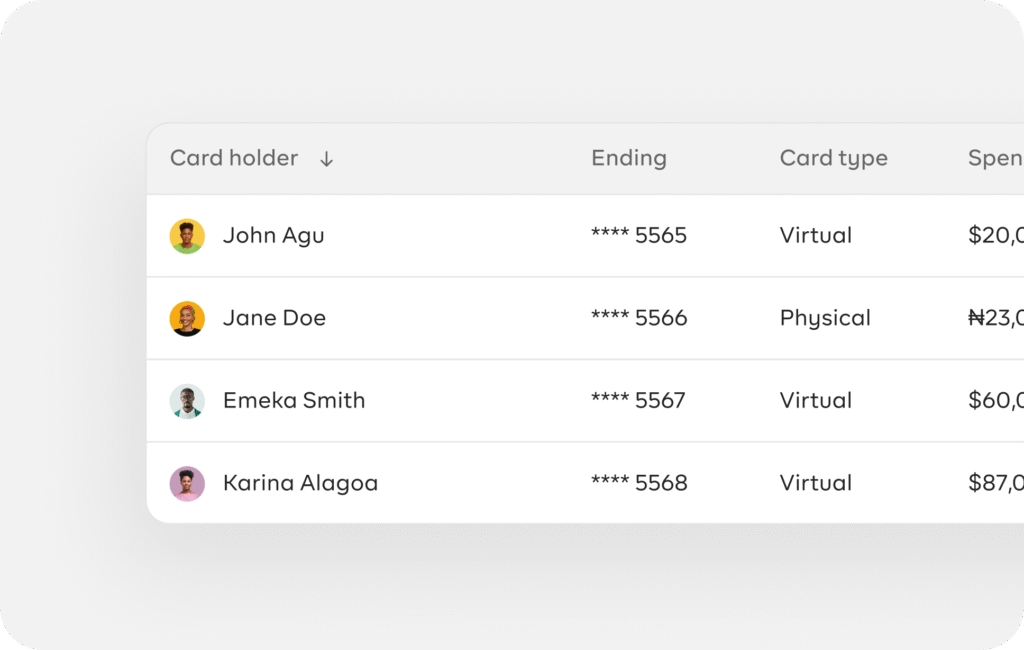

Streamlined expense management

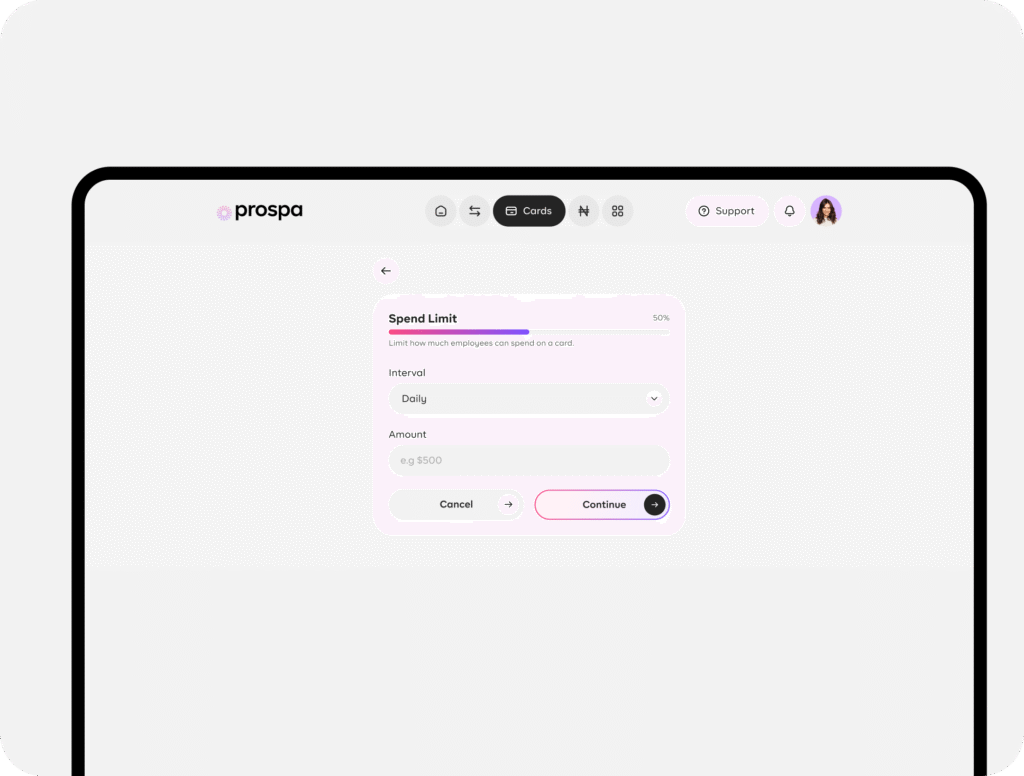

Manage company expenses efficiently with a centralized platform. Issue cards, track usage, and control spending all in one place.

Real-time spending tracking

Monitor and track expenses in real time. Stay on top of spending with instant updates and detailed reports.

Online and offline flexibility

Use expense cards for both online purchases and in-store transactions. Enjoy the convenience of cashless spending wherever your business takes you.

Frequently Asked Questions

Prospa offers both virtual and physical cards to suit different business needs. The Dollar card is available in virtual form only and the Naira Mastercard, is available both as a physical card for in-person transactions (POS, ATM) and as a virtual card within the app for secure online payments.

Prospa’s Naira Mastercard works seamlessly for both online and offline transactions. Our Dollar virtual card is designed specifically for secure online payments in USD, ideal for handling international subscriptions, services, and vendors.

Once you have a Prospa account—whether it's a freelance or business account—you can easily purchase a Dollar virtual card without any additional requirements or paperwork. Simply make payment for the card right within the app, and it will be issued to you instantly, ready for secure international payments in USD.

Freelance accounts on Prospa have full access to purchase expense cards, both the Naira Mastercard and the Dollar virtual card.

Yes, once team members are added to your Prospa business account, you can assign them individual expense cards or link multiple team members to a single card, depending on how your team spends. It’s a flexible way to manage shared or role-based budgets while keeping control and visibility in one place.

Yes, Prospa allows you to link expense cards directly to internal accounts/sub-accounts.

Yes, Prospa lets you define spending limits and usage rules for every card issued.

Absolutely. Every transaction made with a Prospa card is reflected instantly on your dashboard, giving you real-time visibility into how business funds are spent. Each transaction is also logged in a detailed audit trail, making it easy to review, reconcile, and stay compliant with your internal financial controls.

You have full control over every Prospa card right from your app. If a card is lost, compromised, or no longer needed, you can freeze or deactivate it instantly.

Yes, you can have multiple Prospa debit cards linked to your business account. Each card can be assigned to a specific team member.

You can instantly freeze or deactivate any card from your dashboard if a team member leaves or changes roles. Funds remain secure, and the card can be reassigned or terminated based on your preference.

Each Prospa expense card is valid for 2 years from the date of issuance. You can renew it easily within the app.