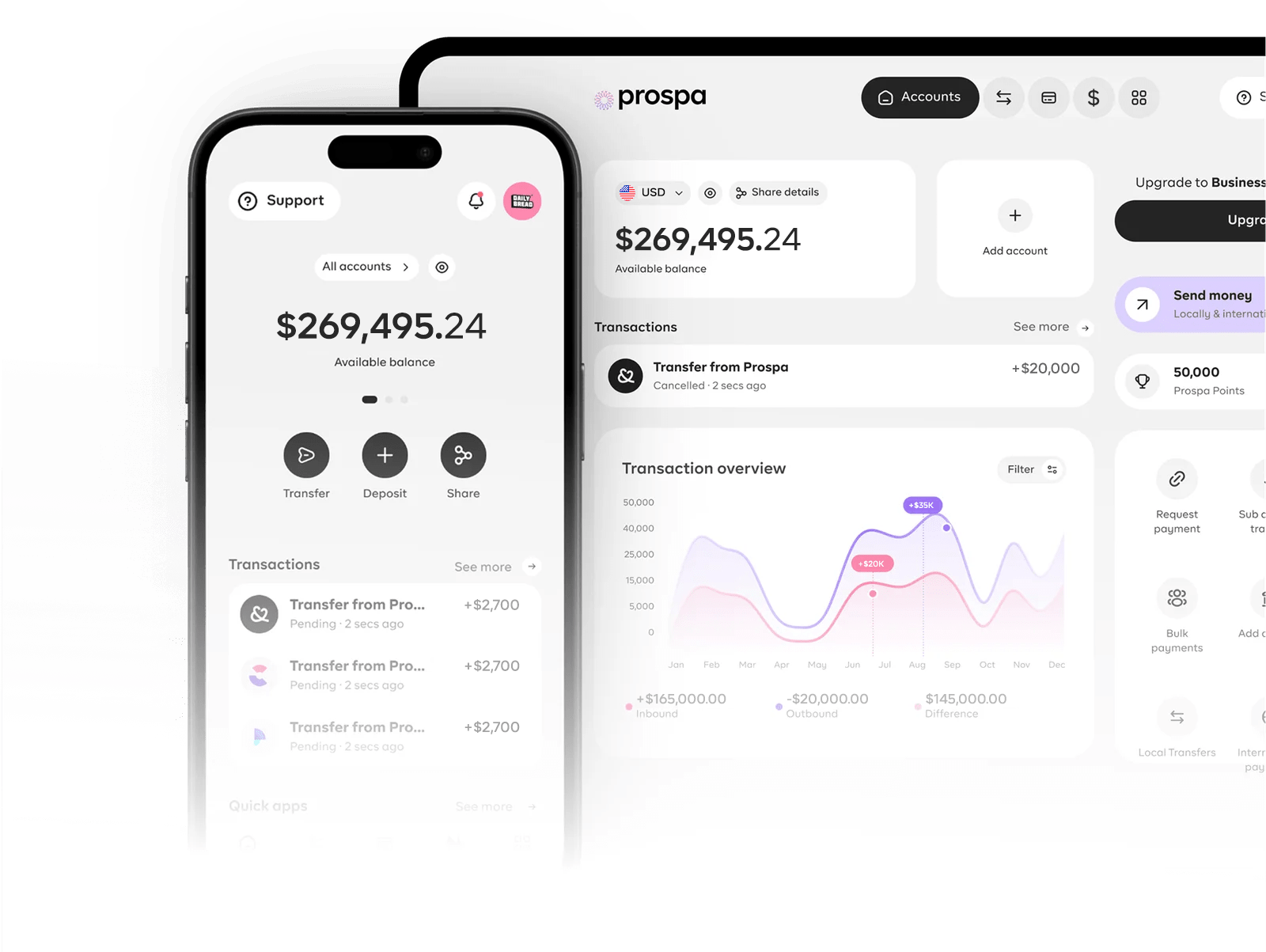

Professional business account in your company name

Open a business account tailored to your brand. Manage funds, receive payments, and conduct transactions under your company’s official name.

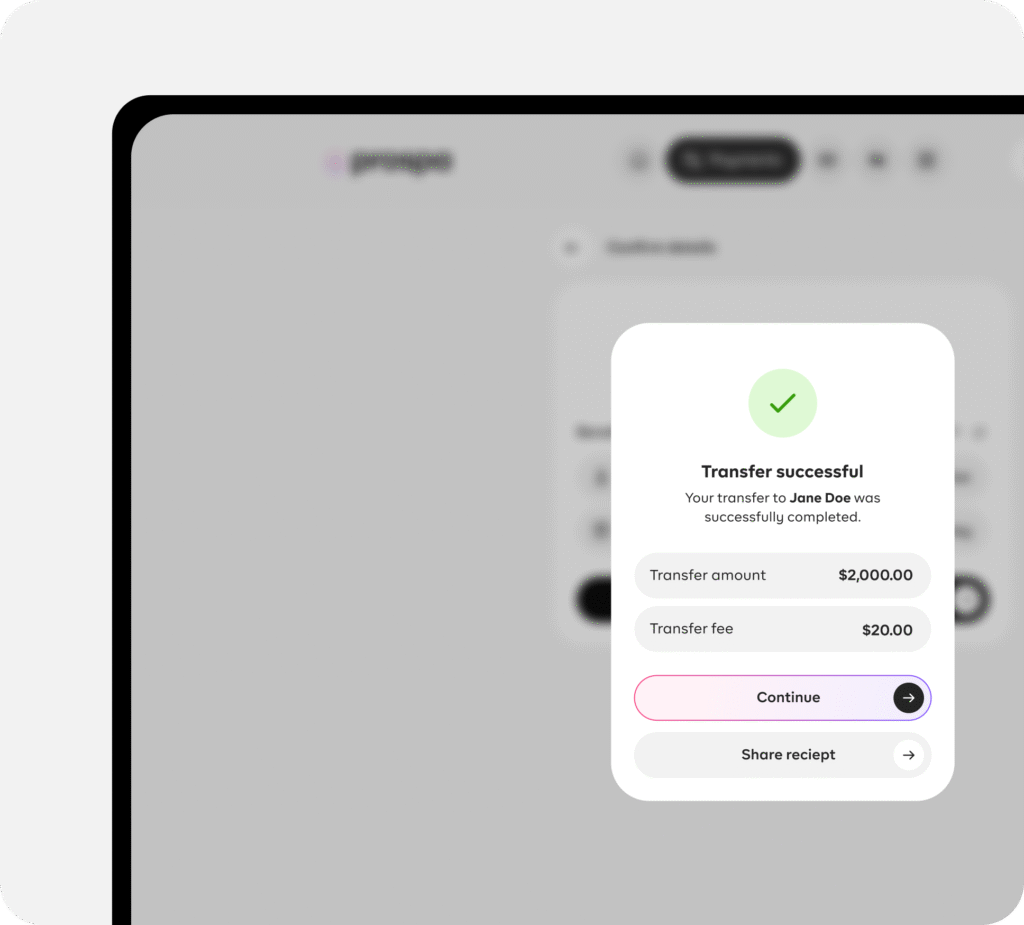

Fast payments, zero delays

Send and receive payments instantly. Keep your business running smoothly with quick and reliable transactions.

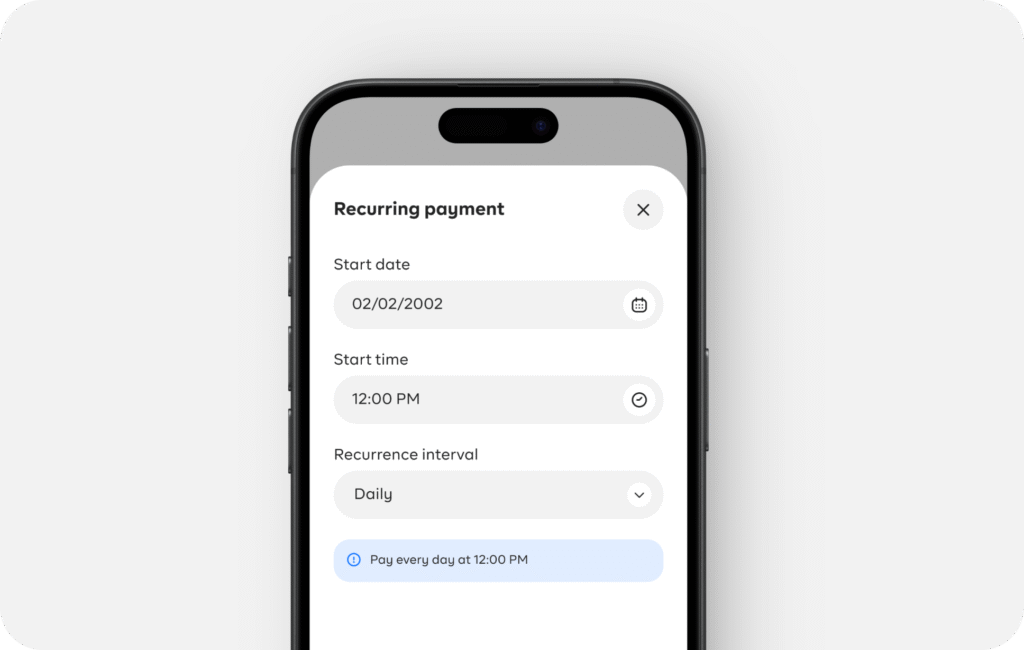

Automated bill payments, on time

Schedule and automate bill payments with ease. Never miss a due date while managing recurring expenses efficiently.

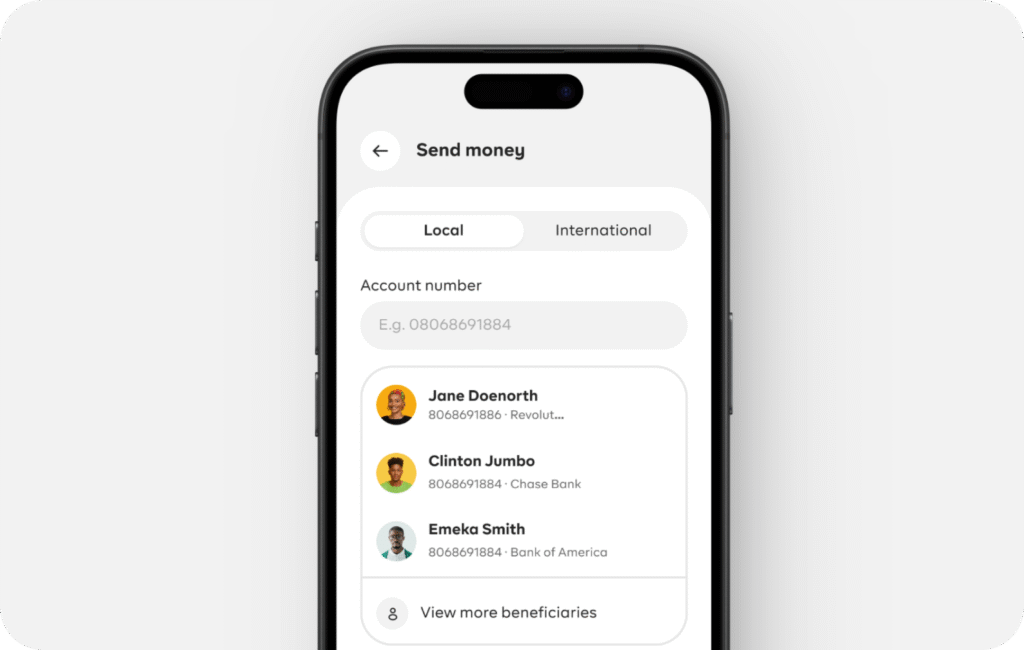

Effortless beneficiary management

Add and manage beneficiaries seamlessly. Pay vendors, employees, and partners in one click.

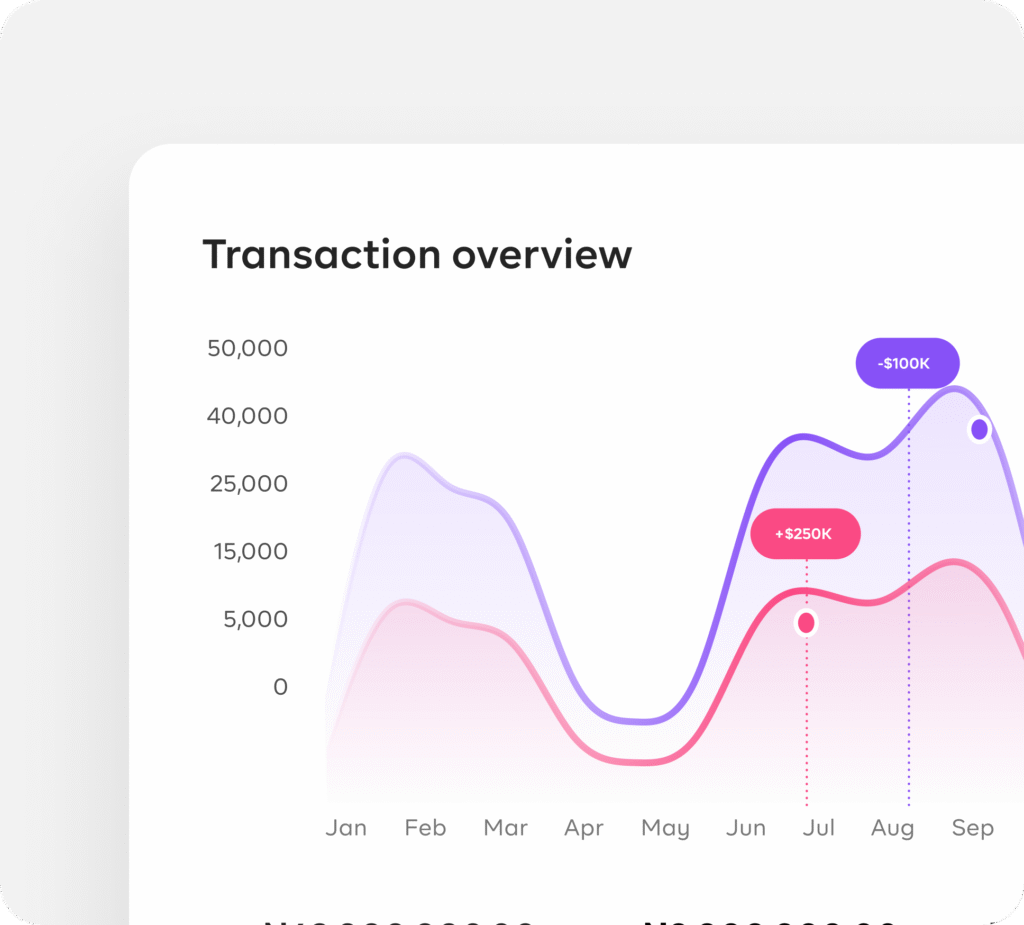

Full financial control, all in one place

Track, manage, and pay bills, invoices, and expenses from a single dashboard. Enjoy streamlined operations with full visibility into your cash flow.

Frequently Asked Questions

Here’s what you’ll need to get started:

Fill out the qualification form under sign-up on our website or by downloading the Prospa app on the Google Play Store or App Store.

Once you’ve submitted your details, our team will review your information, reach out to understand your business needs, and share your onboarding details if you qualify.

If you have any questions, our support team is here to help at help@getprospa.com

Provided all required information and documents are submitted correctly, account set up takes 5 minutes. Our streamlined verification process ensures you can start banking without unnecessary delays.

A business account is a bank account created in a company’s legal name. With Prospa, you can open one online to manage funds, pay bills, and access business loans.

With Prospa, you can run your business with ease using one app that offers quick setup, secure payments, team access, loans, and business cards.