Products to power growth

Supercharge your business with smart banking and intuitive products. The tools you already use, seamlessly integrated.

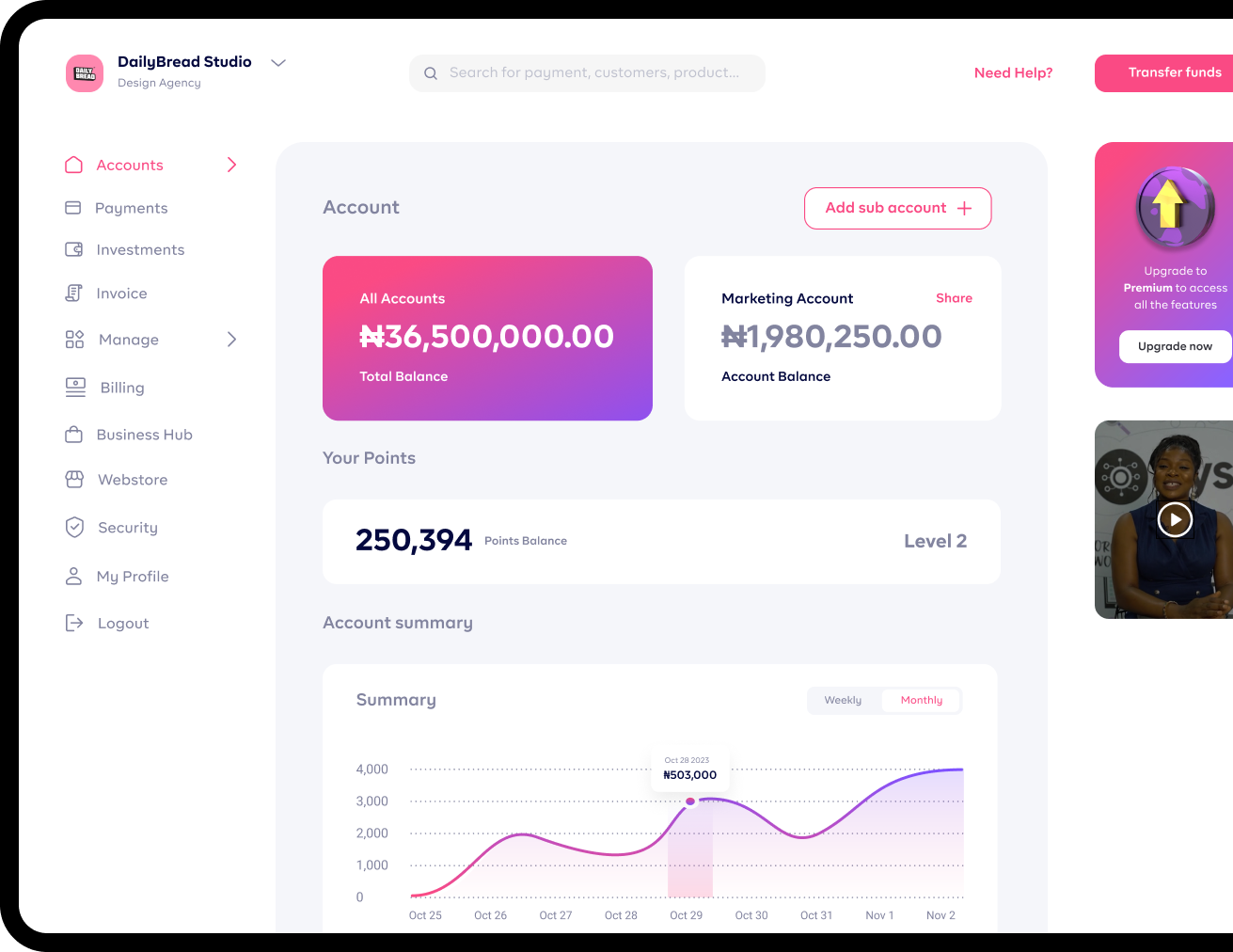

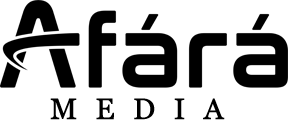

Spend Management

Take full control of spending with, limits, approvals, sub-accounts, team collaboration vendor and employee management.

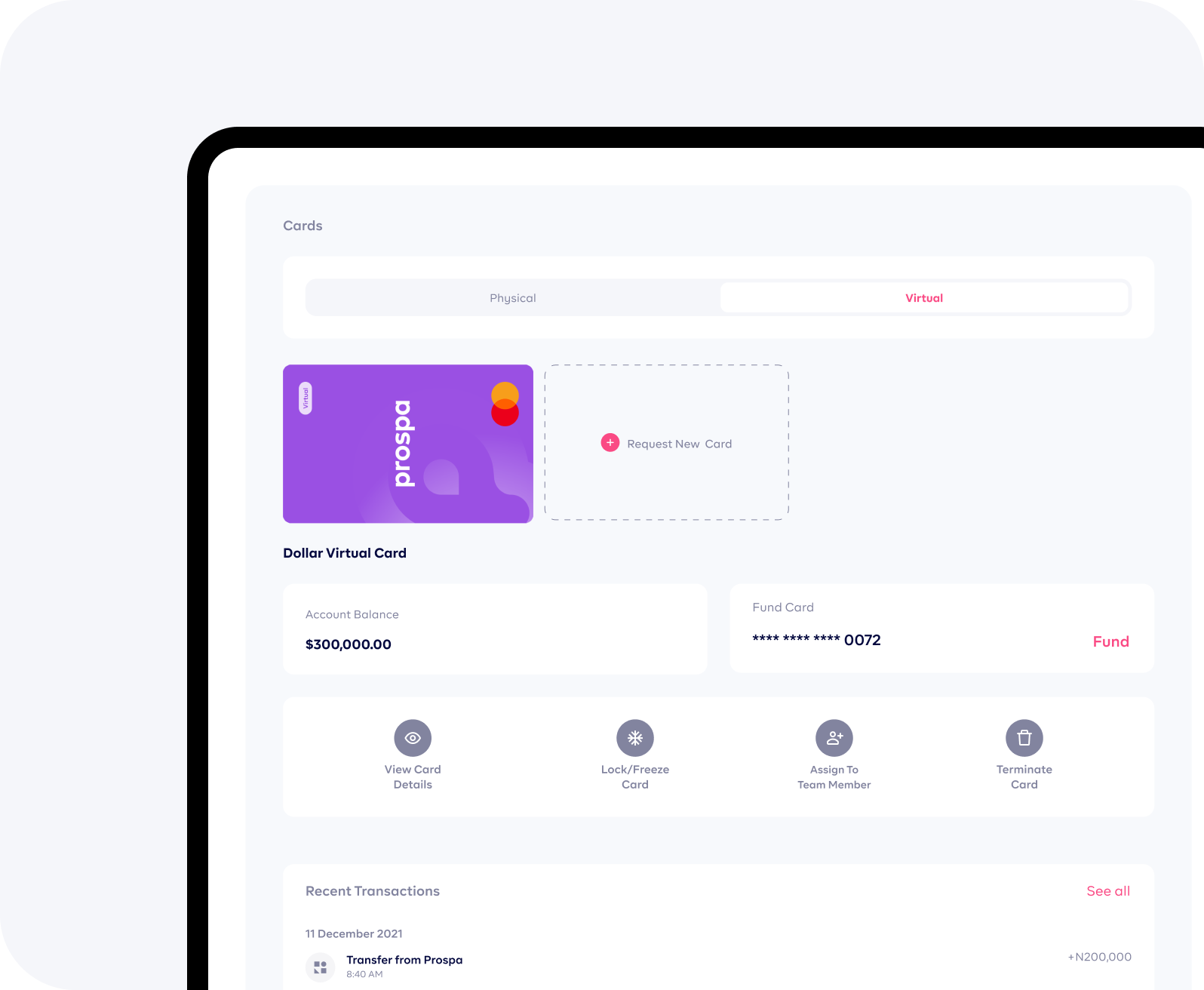

Business Account & Payments

Get an easy to use current account in your business name. Make payments and get paid faster with transfers, cash, USSD and more.

Expense Cards

Quickly issue expense cards for company spending, add team members, use online and offline. Track spend in real time.

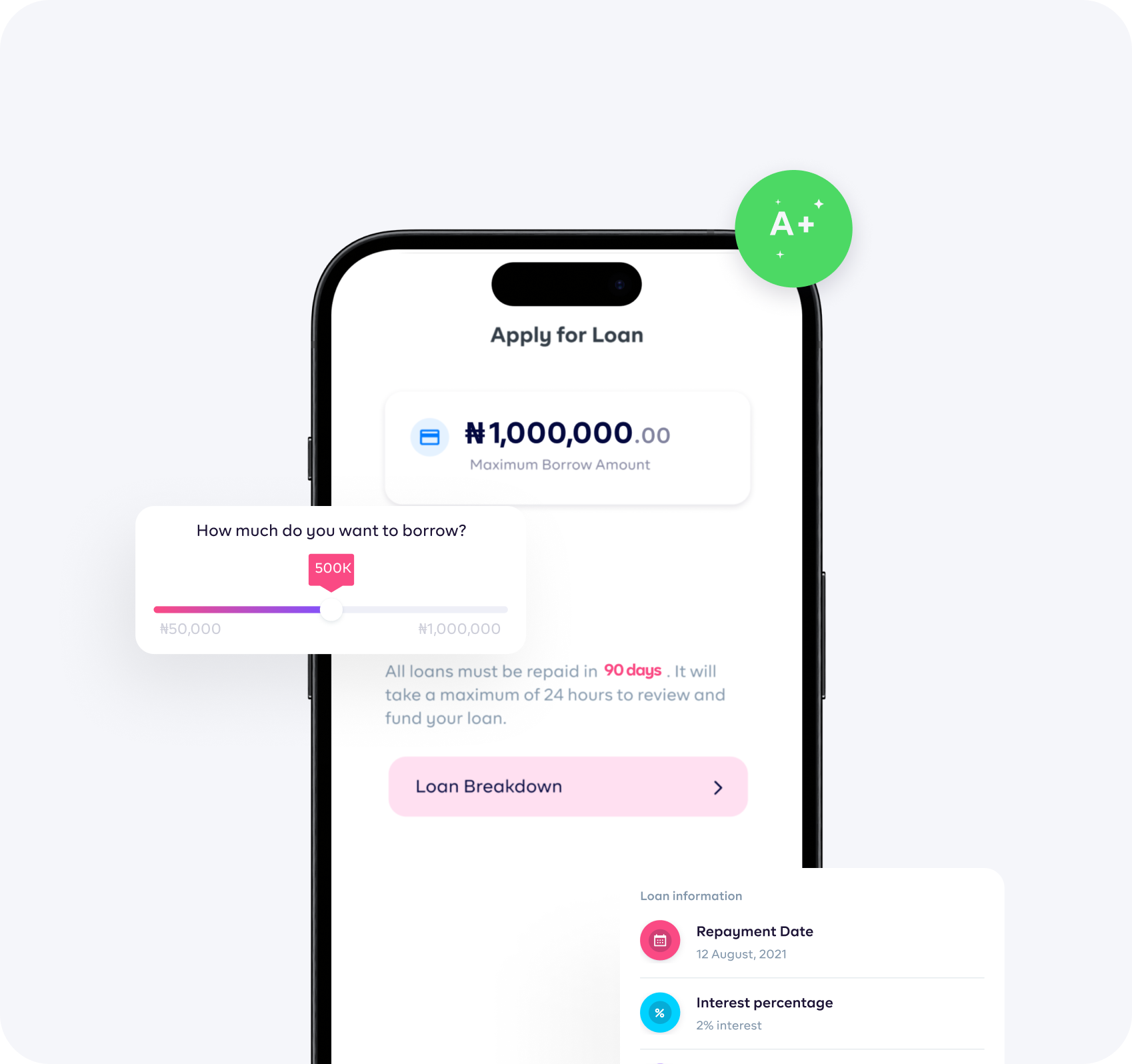

Business Loans

Unlock growth with access to credit

Build your credit and access up to ₦1,000,000 in credit, quickly in the app. Grow your credit rewards up to ₦100,000,000 over time.

Investments

Automate treasury management

Automate liquidity management and earn up to 10% interest on cash balances. Set up from your Prospa dashboard in a few clicks.

Member Story

Oystr uses Prospa to streamline banking and operations

A venture funded startup based in Lagos, Nigeria uses Prospa for day to day payments, monthly payroll and more. Watch the story.

Frequently Asked Questions

Find answers to our most frequently asked questions. Can’t find the answer you're looking for? Email our support team help@getprospa.com

Prospa is more than a bank, it’s your business partner. Providing all the tools you need to start, grow and scale your business, to prosperity and beyond. Open a business bank account in 5 minutes and discover an incredibly fast and easy way to manage your business finances.

Thousands of Nigerian business owners, freelancers, startups and growing companies use Prospa. Packed with features to put your finance operations on autopilot and give you time to focus on growing and succeeding.

Your account comes with:

Bank account number in your business name

Corporate debit cards

Access to instant loans

Receive transfers from all Nigerian banks

Send transfers to all Nigerian banks

Create sub-accounts

Auto-Split your funds across sub-accounts

Manage your customers

Send invoices

Pay bills

Buy airtime

Add team members

Download your statement

Add and manage additional businesses

Extra tools & features to keep your business on autopilot

Integrate with existing software

Transparent and easy to understand fees

No. We do not have a physical branch, however, if you’re interested in becoming a member and want to confirm, you can visit our office address 65 Queens Street, Alagomeji, Yaba, Lagos.

The safety and security of your Prospa account is our highest priority and here are some of the steps we take to ensure accounts are safe.

Requiring HTTPS on all pages, and use HSTS to ensure browsers only ever connect to us over a secure connection. We never store or log your password and transactional PIN data in plaintext. Allowing all members to enable Time-based, One Time Passwords, for two-factor authentication on their account. We never send authentication codes via insecure channels like SMS. Encrypting our database and all uploaded images. We employ additional encryption for sensitive data, like transactional PIN.

Yes, your account is insured up to the NDIC limit. Prospa works with NDIC-insured banks to store your deposits, namely Good News Microfinance Bank.

Most Nigerian company registered with the Corporate Affairs Commission can open an account with Prospa. Charities and NGOs can open an account too. Please note, However, there are a number of high risk industries that we can’t take on, we will not be offering current accounts to businesses in the following industries:

- Third-party funds

- The holding, managing an/or controlling of a third party’s (client’s/customer’s) funds in Prospa accounts. This includes using the funds on behalf of other individuals

- Insurance companies (incl. insurance brokers)

- Trading of cryptocurrencies

- Money services (such as foreign exchange, loan providers, money transfers)

- Casinos, prize draws and other betting or gambling activities

- Sale of unlicensed pharmaceuticals

- Trading of weapons, explosives or armaments

- Unlicensed trading and processing of scrap metal

- Escort services and other services in the adult industry

It takes 5 minutes to sign up providing you have all required documents immidiately available. On average it takes 20 minutes for your account to be approved once you’ve submitted your application, however it can take up to 48 hours if we need more information from you.

Yes. As long as you have a BVN (Bank Verification Number), a registered Nigerian company and all the required KYC information, you can apply from anywhere in the world. If you are in the UK or US with the required documents and need additional assistance please email us help@getprospa.com.

It is totally free to open a Prospa account. We do not charge an account opening fee and we do not require you to maintain a monthly minimum balance. What we do charge you can find below. Please refer to the pricing and billing page for more info on charges.

There are standard transaction charges on outflow:

₦1,000.00 and below - ₦10.75

₦1,000.01 - ₦50,000.00 - ₦26.87

₦50,000.01 and above - ₦53.75

Let’s Prospa Together

Prospa is available on iOS, Android and Web. Open an account today!